Car insurance is a type of financial protection that shields vehicle owners from the financial loss that can occur due to accidents, theft, or damage to their vehicle. It operates on the principle of risk pooling, where multiple policyholders pay premiums into a common fund managed by an insurance company. This fund is then used to cover the costs associated with vehicular accidents or damage as specified in the insurance policies.

The primary purpose of car insurance is to provide financial security against physical damage or bodily injury resulting from traffic collisions, as well as against liability that could also arise from incidents in a vehicle. Policies offer various levels of coverage; some cover the insured party’s vehicle repairs in case of an accident, while others extend to cover damages to other vehicles or property, as well as medical expenses of injured parties.

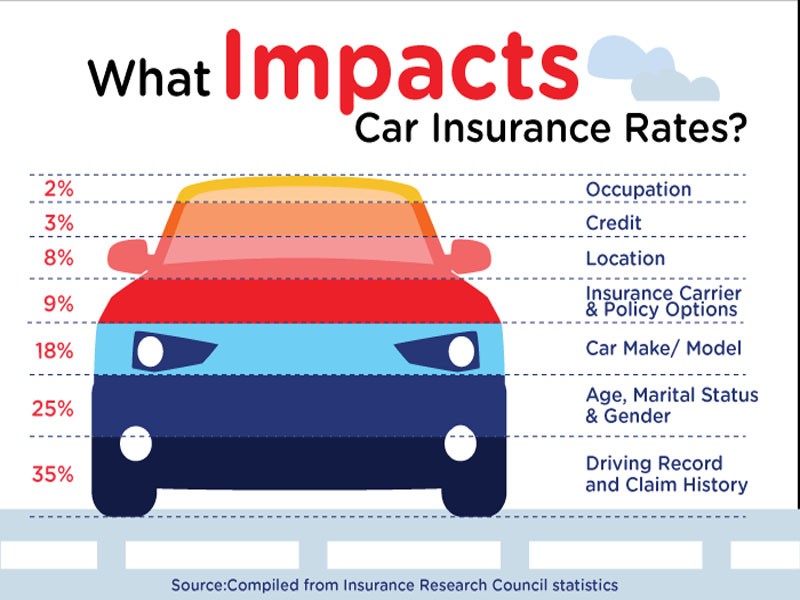

One key aspect of car insurance is the premium, the amount the policyholder pays to maintain coverage. Premium rates are determined based on several factors, including the driver’s age, driving history, the type of vehicle insured, and the level of coverage chosen. Higher-risk drivers typically face higher premiums, reflecting the greater likelihood of claims.

Car insurance policies also feature a deductible, which is the amount the policyholder must pay out-of-pocket before the insurance company covers the remaining costs. A higher deductible usually results in a lower premium, but it means more financial responsibility for the policyholder in the event of an accident. car accident attorney long beach, long beach car accident attorney, car accident injury attorney long beach, car accident attorney in long beach, business internet providers los angeles, personal injury lawyer in colorado, personal injury lawyer in denver colorado, personal injury lawsuit lawyer in colorado, san bernardino car accident attorney, car accident attorney san bernardino, motorcycle accident attorney san bernardino, san bernardino motorcycle accident attorney, san bernardino accident attorney.

There are various types of car insurance coverages. Liability coverage, mandatory in most jurisdictions, covers damages to other people or property if the policyholder is at fault in an accident. Collision coverage pays for damages to the policyholder’s vehicle resulting from a collision, regardless of who is at fault. Comprehensive coverage provides protection against theft and damage from non-collision-related incidents like fire, vandalism, and natural disasters.

In conclusion, car insurance is an essential tool for mitigating financial risks associated with vehicle ownership and usage. It not only helps in protecting the policyholder from potentially crippling financial liabilities following an accident but also ensures compliance with legal requirements in many regions. By selecting appropriate coverage levels and understanding the terms of their policy, vehicle owners can achieve peace of mind and financial security.

Car insurance keywords

Auto Insurance Liability Coverage Collision Coverage Comprehensive Insurance Premiums Deductibles Uninsured Motorist Underinsured Motorist Personal Injury Protection (PIP) Property Damage Liability Bodily Injury Liability Insurance Claims Policy Renewal Insurance Quotes Risk Assessment Accident Forgiveness No-Claim Bonus Coverage Limits Actuarial Tables Telematics Gap nsurance Excess Payment Insurance Fraud Defensive Driving Discount Multi-Car Discount Vehicle Safety Rating Roadside Assistance Insurance Broker Insurance Policy Driving Record Act of God Coverage Rental Reimbursement Legal Requirements Insurance Adjuster Financial Responsibility Teen Drivers SR-22 Driving Behavior Vehicle Classification Insurance Binder Third-Party Insurance Direct Compensation Policy Exclusions Indemnity Insurance Premium Tax Rate Calculation Claims History Insurance Deductible Policyholder Driving Experience.

Car insurance Tips

Car insurance is a crucial aspect of vehicle ownership, offering financial protection and peace of mind. Here’s an overview of car insurance, broken down into key points:

Definition and Purpose:

Car insurance is a contract between a vehicle owner and an insurance company, where the owner pays premiums and, in return, receives financial protection against losses from vehicle-related incidents.

Its primary purpose is to protect against financial loss from accidents, theft, or damage to the vehicle, as well as liability for damage or injuries caused to others.

Types of Coverage:

Liability Insurance:

Covers costs if you are responsible for an accident, paying for the other party’s vehicle repairs and medical expenses.

Collision Insurance:

Covers repairs to your own vehicle after an accident, regardless of who was at fault.

Comprehensive Insurance:

Protects against non-collision-related damage, such as theft, vandalism, or natural disasters.

Uninsured/Underinsured Motorist Protection:

car accident attorney long beach, long beach car accident attorney, car accident injury attorney long beach, car accident attorney in long beach, business internet providers los angeles, personal injury lawyer in colorado, personal injury lawyer in denver colorado, personal injury lawsuit lawyer in colorado, san bernardino car accident attorney, car accident attorney san bernardino, motorcycle accident attorney san bernardino, san bernardino motorcycle accident attorney, san bernardino accident attorney

Offers coverage if you’re involved in an accident with a driver who has insufficient or no insurance.

Personal Injury Protection:

Covers medical expenses for you and your passengers, regardless of fault.

Determining Premiums:

Premiums are calculated based on risk factors such as age, driving history, vehicle type, and geographical location.

Higher-risk profiles, like young or inexperienced drivers, often result in higher premiums.

Deductibles:

A deductible is an amount the policyholder pays out of pocket before the insurance coverage kicks in.

Choosing a higher deductible can lower the premium cost, but increases out-of-pocket expenses in the event of a claim.

Legal Requirements:

Most jurisdictions require a minimum level of liability insurance for all vehicles.

Driving without insurance can result in fines, license suspension, or vehicle impoundment.

Additional Benefits:

Some policies offer extras like roadside assistance, rental car coverage during vehicle repairs, and coverage for custom parts and equipment. car accident attorney long beach, long beach car accident attorney, car accident injury attorney long beach, car accident attorney in long beach, business internet providers los angeles, personal injury lawyer in colorado, personal injury lawyer in denver colorado, personal injury lawsuit lawyer in colorado, san bernardino car accident attorney, car accident attorney san bernardino, motorcycle accident attorney san bernardino, san bernardino motorcycle accident attorney, san bernardino accident attorney

Claims Process:

In the event of an accident or loss, the policyholder must file a claim with their insurer.

The insurance company assesses the claim and, if valid, pays for the repairs or losses up to the policy’s limit.

Choosing the Right Policy:

It’s important to compare policies and insurers to find the best coverage for your needs and budget.

Understanding the terms, coverage limits, and exclusions of a policy is crucial before making a decision.

Renewal and Adjustments:

Car insurance policies are typically renewed annually.

Policyholders should review and adjust their coverage as needed to reflect changes like a new vehicle purchase, relocation, or a change in driving habits.

Impact of Technology:

Advances in technology, such as telematics and online comparison tools, are transforming how premiums are calculated and how customers shop for insurance.

Conclusion

In conclusion, car insurance is an essential tool for any vehicle owner, offering not just compliance with legal requirements but also providing financial protection and peace of mind. It covers a range of potential financial losses related to vehicle accidents, theft, damage, and liability. The importance of understanding the various types of coverage – liability, collision, comprehensive, personal injury protection, and uninsured/underinsured motorist coverage – cannot be overstated. Each type serves a specific purpose and offers different levels of protection. When choosing a policy, factors such as the vehicle type, driving history, geographical location, and personal needs should be considered. Additionally, understanding the balance between premium costs and deductibles is crucial in selecting a policy that provides adequate coverage without being financially burdensome. Moreover, staying informed about your policy, regularly reviewing and updating it to suit changing circumstances, and practicing safe driving habits are key to maintaining affordable and effective coverage. With the evolving landscape of car insurance, particularly with technological advancements like telematics, it’s more important than ever for consumers to stay engaged with their insurance needs. car accident attorney long beach, long beach car accident attorney, car accident injury attorney long beach, car accident attorney in long beach, business internet providers los angeles, personal injury lawyer in colorado, personal injury lawyer in denver colorado, personal injury lawsuit lawyer in colorado, san bernardino car accident attorney, car accident attorney san bernardino, motorcycle accident attorney san bernardino, san bernardino motorcycle accident attorney, san bernardino accident attorney

FAQs

What is car insurance?

Car insurance is a contract between you and an insurance company that protects you against financial loss in the event of an accident or theft. In exchange for your paying a premium, the insurance company agrees to pay your losses as outlined in your policy.

Why do I need car insurance?

Car insurance is required by law in most places to protect yourself and others from the high costs associated with car accidents. It also covers vehicle repairs, theft, and damages caused by natural disasters, depending on the coverage.

What are the different types of car insurance coverage?

The main types are liability coverage (for damages you cause to others), collision coverage (for damage to your car from a collision), comprehensive coverage (for non-collision damage like theft or weather), personal injury protection, and uninsured/underinsured motorist coverage.

How is my car insurance premium calculated?

Premiums are calculated based on factors like your age, driving history, vehicle type, and location. High-risk drivers typically pay higher premiums. What is a deductible in car insurance? A deductible is the amount you pay out of pocket for a claim before your insurance covers the rest. Choosing a higher deductible can lower your premium. Is car insurance valid in other states or countries? Insurance typically covers you in all states, but coverage in other countries varies. Check with your insurer before traveling abroad. Can I change my car insurance policy? Yes, you can usually change your policy at any time. However, changes might affect your premium. What happens if I don’t have car insurance? Driving without insurance can result in fines, license suspension, and even jail time. It also leaves you financially vulnerable to the costs of accidents. Does my driving record affect my insurance rates? Yes, a poor driving record with traffic violations or accidents typically leads to higher rates. What should I do if I’m involved in a car accident? Ensure everyone’s safety, call the police, exchange information with the other driver, take photos of the scene, and report the accident to your insurance company as soon as possible. How do I file a car insurance claim? Contact your insurance company immediately after an accident. Provide them with all the necessary information and documentation they require. Does car insurance cover theft? Yes, if you have comprehensive coverage, it includes theft of your vehicle. Are there discounts available for car insurance? Many insurers offer discounts for things like a good driving record, multiple cars on one policy, or installing safety devices in your vehicle. car accident attorney long beach, long beach car accident attorney, car accident injury attorney long beach, car accident attorney in long beach, business internet providers los angeles, personal injury lawyer in colorado, personal injury lawyer in denver colorado, personal injury lawsuit lawyer in colorado, san bernardino car accident attorney, car accident attorney san bernardino, motorcycle accident attorney san bernardino, san bernardino motorcycle accident attorney, san bernardino accident attorney What factors should I consider when choosing a car insurance policy? Consider factors like the insurer’s reputation, coverage options, deductible amounts, premium costs, and customer service. How often should I review or update my car insurance policy? It’s a good idea to review your policy annually or after major life changes (e.g., buying a new car, moving, or adding a driver to your policy).